Claiming Dependents: What Happens When Your Kids Fly the Coop? | How Money Walks | How $2 Trillion Moved between the States - A Book By Travis H. Brown

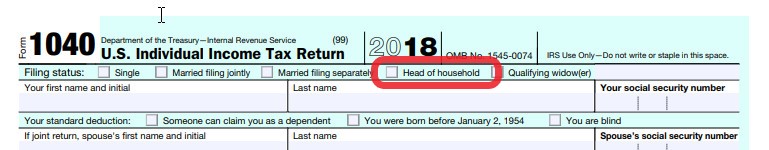

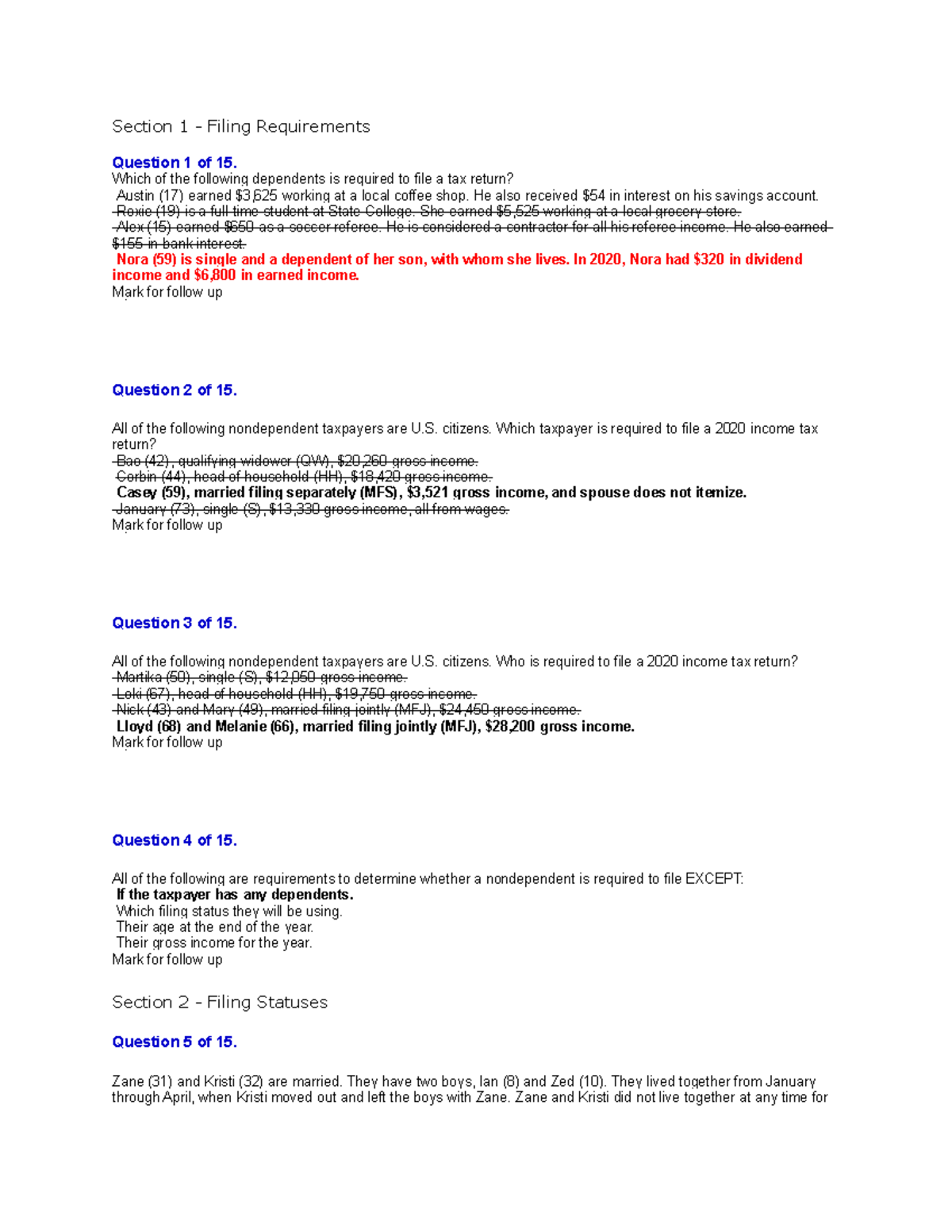

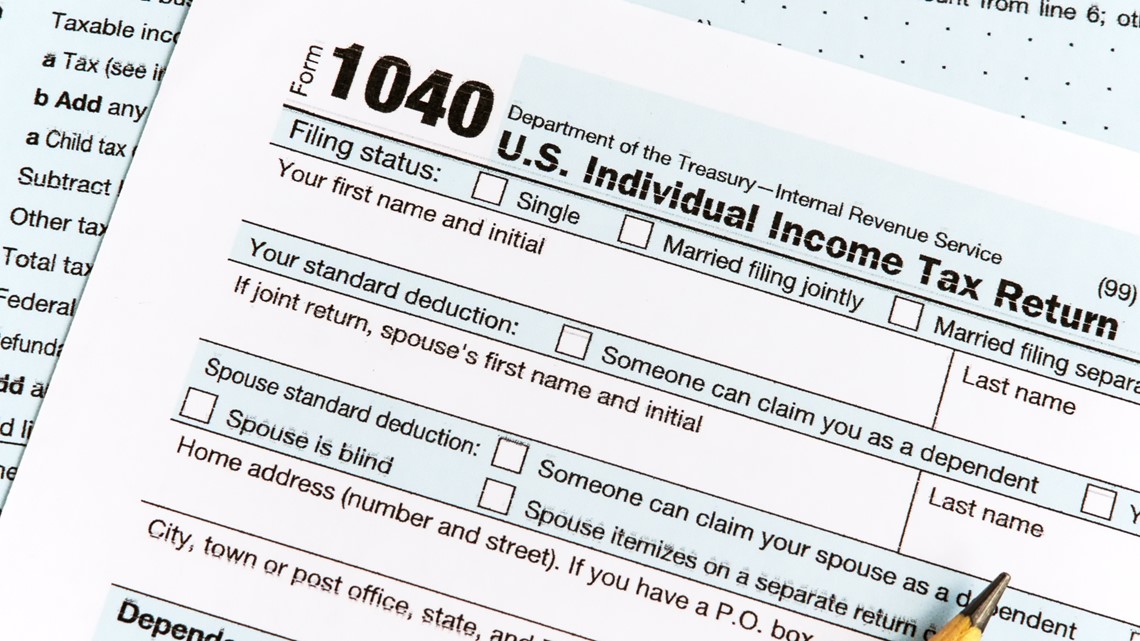

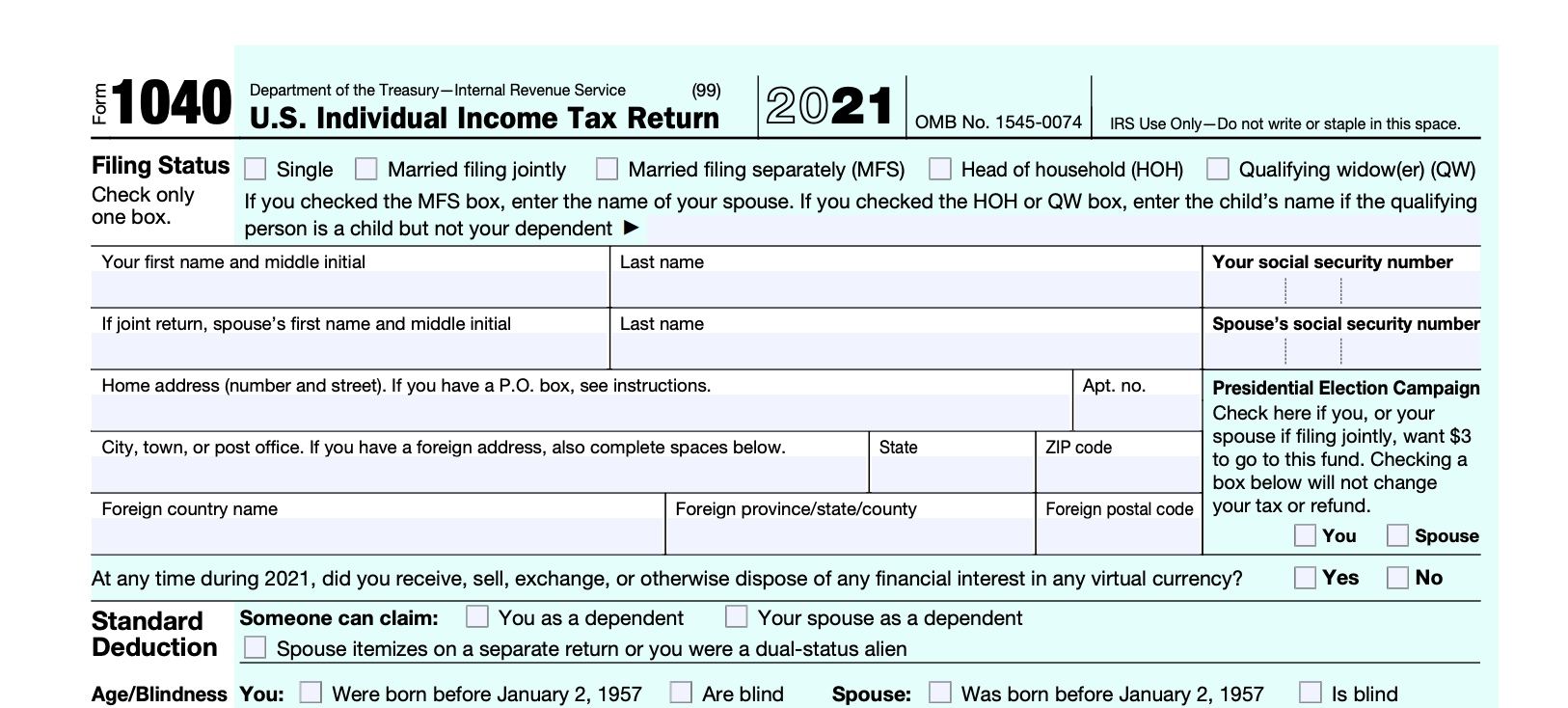

Tax Specialist Overview Part 1 - Section 1 - Filing Requirements Question 1 of 15. Which of the - Studocu

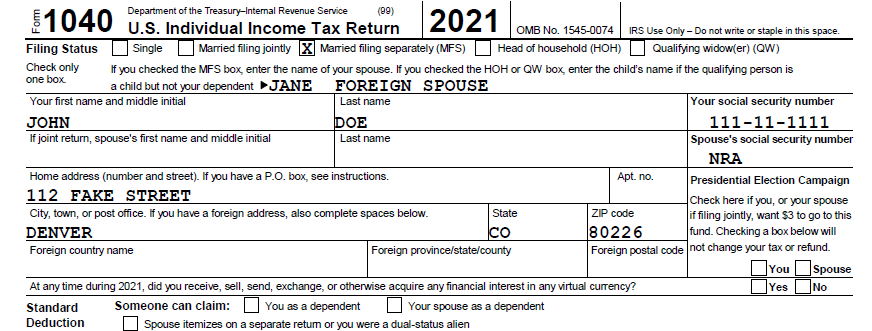

Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If You're “Married Filing Separately?” - O&G Tax and Accounting

:max_bytes(150000):strip_icc()/headofhousehold-b7e9af51251b46a7a108a878b7cf2da3.png)